Analysis on the development trend of China lead-acid battery industry in 2018

Analysis on the development trend of China lead-acid battery industry in 2018

Lead acid battery market segment competition is fierce, scale advantage is the key.

Domestic lead-acid battery market is relatively concentrated, chemical power lead-acid battery industry more competitive, product price competition and cost increase the net profit margin of the main manufacturers in the industry are greatly reduced.

As residents rising on the battery performance requirements, country to the environmental protection is becoming more and more attention and the drive up, industry barriers to entry in the industry has scale advantage enterprises will get more development opportunities, and by way of expansion and merger and acquisition further expand the scale, industry concentration will be improved.

Upstream high-end battery manufacturers have strong bargaining power.

Upstream of lead-acid battery industry including lead, sulfuric acid, such as plastic, lead-acid battery industry, the demand for raw materials, lead and sulphuric acid industry as a whole presents the excess production capacity, and battery is one of the important downstream applications, lead to sulfuric acid of lead and lead-acid battery industry has strong bargaining power.

And plastic is in short supply, the battery industry has a higher demand for the characteristics of plastic, so the bargaining power of the plastics industry is lower.

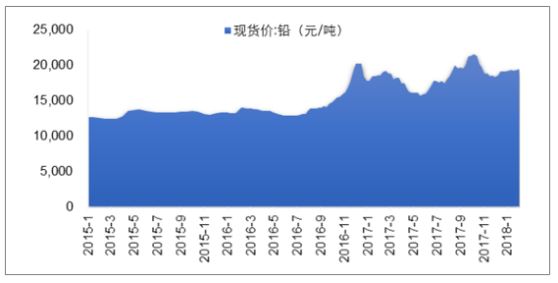

The upstream of lead-acid batteries is mainly the raw material industry, which is greatly affected by price fluctuation.

Upstream raw materials are affected by environmental protection policies, and their prices fluctuate greatly, which has a significant impact on the cost of the battery industry.

The upstream of traders is the lead smelting industry, which has great influence on enterprises because lead and calcium alloys account for the majority of the cost of lead-acid batteries.

At present, the number of domestic lead smelting enterprises is large and the competition is fierce.

As domestic environmental pressures and to improve the quality of the product requirements, smelting technology behind the small and medium-sized enterprise survival space will be narrowed, mergers and reorganization will lead smelting industry concentration further increased.

In order to reduce the impact of raw material price fluctuations on the profitability of the industry, enterprises will generally establish a lead price linkage mechanism with customers on product sales prices

From 2015 to 2018, the price of lead - acid battery raw material has a significant trend

Source: open data collection

The downstream demand drives the industrial upgrading, the lead-acid battery industry barriers appear, high-end battery bargaining power is strong.

In recent years, China's lead-acid battery industry, with the development of downstream demand, has a good profitability and a high profit margin, which is attractive to potential entrants.

At the same time, the state has issued a series of policies to standardize the industry, raising the entry threshold of the industry, and showing the industry barriers.

Downstream industry mainly cars, electric cars, communications, new energy, such as the current bargaining power lead-acid battery industry as a whole is low, but high-end lead-acid battery products production enterprise bargaining power is relatively high.

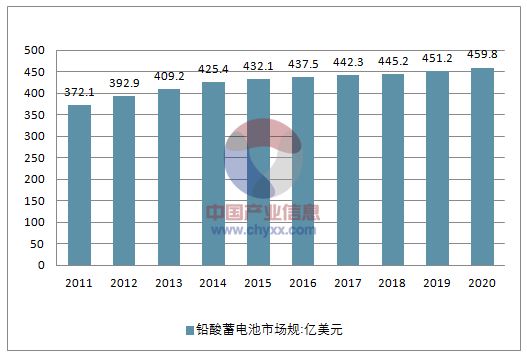

Global lead-acid battery market scale forecast

Source: open data collection

Car start - stop battery gross profit rate high technical barriers.

The starting and stopping battery has higher requirements than the normal starting battery due to more frequent start-up and the requirement of power supply for vehicle electric appliances when idle.

By 2018, the penetration rate of starting and stopping batteries will reach 50%, about 13.5 million sets.

In 2020, the penetration rate will reach 70%, and about 21 million sets will be shipped, with an output value of 14 billion yuan.

The period from 2015 to 2018 is the golden growth period of China's automobile start and stop batteries, with compound annual growth rate as high as 46%.

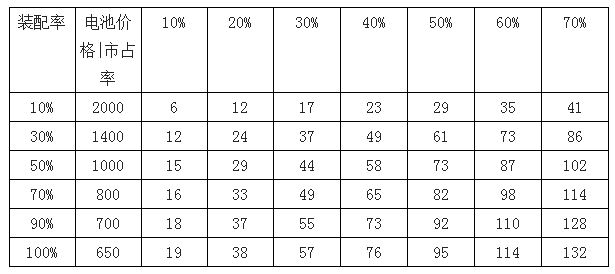

Market sensitivity analysis of start-up and stop batteries for 29.11 million new vehicles sold in 2020 (billion yuan)